Here at Convergent Movement and Performance, we have enormous recognition and respect for the physical and financial commitment involved in physical therapy, rehabilitation, and self-improvement.

Our mission is to assist you as much as possible in all aspects of the process. Therefore, we have assembled this guide to help you effectively navigate through the health insurance maze.

Included on this page is a step-by-step guide to determining, understanding, and utilizing your out-of-network insurance benefits.

Please do not hesitate to ask us any questions you may have regarding your insurance benefits and the payment structure. We will always do all we can to help you in the process of achieving your goals.

Because we are an out-of-network clinic, we are unable to provide physical therapy services (in person or through telehealth) to those with Medicare, Medicaid, and Military-based insurances.

We are however able to provide certain wellness and fitness services without restrictions.

Nonetheless, it is very important to us that we help you along your journey to ensure you receive the best possible care and treatment. Therefore, please do not hesitate to contact us and simply state that you have one of the previously mentioned insurance plans. Although we may not be able to treat you directly, we will do all we can to help navigate you to the most appropriate healthcare provider.

In-network physical therapy services indicate that the physical therapy practice has signed a contract with the insurance company. This contract is based on the agreement that the insurance company will list and promote the physical therapy practice as a “preferred” location only if that physical therapy practice agrees to accept payment for services at the dollar amount that the insurance company chooses to pay.

This dollar amount of course is far less than that of what the physical therapy services actually cost.

Therefore, because the physical therapy clinic receives significantly reduced reimbursement by being “in-network,” they are required to see more patients per hour to make up for the difference in reimbursement so that the clinic can stay in business. This means that there will likely be more patients present within a particular time span, resulting in less overall attention placed on each individual patient.

In addition, many of these contracts also dictate which services may or may not be covered. Therefore, only those services that the insurance company dictates are acceptable will be included within in-network coverage. Because of this, the insurance company often indirectly influences the quality and type of care you receive.

Take the time to consider and realize that when remaining in-network, the decision makers within the insurance company include individuals who you have never met, who have no personal understanding of your condition, and are not medical professionals physically present in your care. These decision makers have the power and influence to make the crucial decisions of what assessment, testing, and treatment are permitted to be involved in your care. In addition, they determine when you are considered to be “done” with treatment.

You may be noticing that it is commonplace that more and more physical therapy clinics and other healthcare providers are venturing out-of-network. After reading through the previous in-network section, I am confident that you now understand exactly why many patients and their clinicians are beginning to prefer out-of-network physical therapy care.

By remaining out-of-network, the physical therapist and patient regain full control of the care, and ensure that a third party cannot deny or limit the services that patient may receive. These conditions allow for an environment that is more conducive to potentially faster and more profound results.

Therefore, because our mission is to always do all we can in assisting you to reach your personal goals and full potential, we have no choice but to remain out-of-network.

We strongly believe in the benefits of individualized one-on-one services. This means that 100% of the attention is always on you for the full length of each session. And to top it off, 100% of your care is provided by Dr. Gene Ketselman, a licensed Doctor of Physical Therapy. This means that you will never be passed down to an aide, tech, or assistant.

If you hope to receive insurance reimbursement, it is important to contact your insurance provider to determine whether you have out-of-network physical therapy benefits, and determine the details of your plan.

The following includes suggested steps for determining your out-of-network insurance benefits. Please click on each step for additional details.

Ask the customer service provider to quote your physical therapy benefits in general. These are frequently termed “rehabilitation” benefits and can include occupational therapy, speech therapy, and sometimes massage therapy.

“Do I have out-of-network benefits for outpatient physical therapy? Do I have coverage when seeing a non-preferred out-of-network physical therapy provider?” (YES / NO)

Note: This step (Step 4) is only required if you wish to seek reimbursement for services performed outside of the ‘1200 US Highway 22 East, Suite 2000, Bridgewater, NJ 08807’ or ‘223 Stirling Rd, Warren, NJ 07059’ locations.

This includes telehealth.

Convergent Movement and Performance offers specialized services for select cases where Dr. Ketselman is able to travel to your home, gym/fitness facility, sporting practice or event, or place of work to provide “in action” and on-site services and care.

We also provide telehealth services.

Unfortunately, insurance companies do not always reimburse services provided outside of the outpatient clinic. Therefore, please be sure to check with you insurance provider prior to starting services if you hope to be reimbursed.

For Telehealth:

***Please keep in mind that Convergent Movement and Performance is able to provide services within all of these locations regardless of whether your insurance provider offers reimbursement. The purpose of discussing this with your insurance provider is to determine whether you may be reimbursed for these services. It does not preclude you from receiving the services.

“Do I have a deductible that must be met prior to receiving reimbursement for out-of-network physical therapy services?” (YES / NO)

FAQ: What is a deductible?

This is the total amount you must pay out-of-pocket before your insurance starts to pay.

For example, if your deductible is $1,000, then your insurance won’t pay anything until you have paid $1,000 for services subject to the deductible (keep in mind that the deductible may not apply to every service you pay for).

Furthermore, even after you’ve met your deductible, you may still owe a copay or co-insurance for each visit.

A deductible must be satisfied before the insurance company will pay for therapy treatment. Submit all bills to help reach the deductible amount.

“What reimbursement will I receive when seeing an out-of-network physical therapy provider?”

Additional information

“Am I required to have a written prescription from a physician or other healthcare provider in order to be covered for out-of-network outpatient physical therapy services?” (Yes/No)

Additional information

If your policy requires a prescription or referral from another healthcare provider you must obtain one to send in with the claim. If the referral from an MD or specialist is all you need, make sure to have a copy to include with your claim. Each time you receive an updated referral you’ll need to include it with the claim.

“Am I required to receive pre-authorization, or have a referral on file, prior to beginning out-of-network physical therapy services?” (Yes/ No)

Additional information

If your policy requires pre-authorization or a referral on file and the insurance company doesn’t have one listed yet, you’ll need to call your physician’s office.

Ask them to file a referral for your physical therapy treatment that is dated to cover your first physical therapy visit.

Be aware that referrals and pre-authorizations have an expiration date and some set a visit limit.

If you are approaching the expiration date or visit limit you’ll need your physician to submit a request for more treatment.

“Is there a $ or visit limit in how much out-of-network physical therapy services I can be reimbursed for per year? (Yes / No)

“I plan to independently submit my own claims on my own behalf for out-of-network physical therapy services…”

“Is there any additional information I should be aware of in terms of submitting for, and receiving, reimbursement for out-of-network physical therapy services?”

If you have “out-of-network” physical therapy benefits, you may be able to use these benefits towards physical therapy services. Please reference the previous section on “Determining Your Insurance Benefits” to better understand your individual coverage.

Please note: In the eyes of insurance, they most often only consider services as “physical therapy” if we are directly addressing a physical pain, injury, or limitation. Wellness, fitness, and/or injury prevention services are NOT covered by insurance benefits.

As long as you have appropriate out-of-network coverage, you can receive reimbursement for physical therapy services by independently filing the claim with your insurance company.

After each session, we can provide you with a receipt that contains all the important information (such as session information, diagnosis codes, and treatment codes) needed to submit to your insurance company. Please be sure to ALWAYS include a copy of each receipt (we provide) when submitting your claims.

Also please keep in mind that there is most likely an additional form that your insurance company will ask you to fill out and send along with the receipt we provide. Please check with your insurance company to learn what their specific procedures are to submit for out-of-network reimbursement. The form your insurance company will ask you to fill out will likely ask for your contact information and the details of your insurance plan.

With select insurance companies, the form they ask you to fill out may also ask you to write key session details (including diagnoses and procedure codes). If this is the case, please reference the following in order to know where to find key information on the receipt:

Your insurance company may ask you to specify the “Place of Service,” which represents the location at which you received physical therapy services.

The “Place of Service” is often referenced as a number. You will find the appropriate Place of Service number for your visit listed in the “Place of Service Location Code” section of your receipt.

If they ask for a specific location (address) of where the service took place, you may reference the “Location of Service” section of the receipt.

***Important Note: Please read the insurance form your are completing carefully, as some insurance companies use their own unique Place Of Service Numbers/Codes. In these cases, they will include a key on the form that specifies which Place of Service number to use. Select and write the most appropriate one. For office visits, look for codes that correspond to the following options:

Your insurance company may ask you to specify your diagnosis. If this is the case, please reference the “Diagnosis Code/s (ICD-10)” section of the receipt. Please be sure to record all ICD-10 codes listed on your receipt (in the order listed on the receipt).

In this section of the receipt, you will find the diagnosis number (ICD-10 Code), as well as a description of the diagnosis in parenthesis. Most insurance forms will only ask for the numeric code, but if they also ask for a description then you may record what’s in the parenthesis.

Your insurance company may ask you to specify which procedures or services were provided during your appointment.

If this is the case, please reference the “Procedure Code (CPT)” section of the receipt. Please be sure to record all CPT codes listed on your receipt (in the order listed on the receipt).

In this section of the receipt, you will find the numeric CPT code/s, as well as a description of the procedure/service in parenthesis. Most insurance forms will only ask for the numeric code, but if they also ask for a description then you may record what’s in the parenthesis.

Your insurance provider may ask you to specify “charges” for each CPT code, as well as “total charges.”

If the insurance company is asking for “charges” associated with a SINGLE CPT code, then you may find the appropriate value listed under the “Session Charges ($ Fee/Unit)” section of the receipt. In this case, you are listing the amount of money owed per unit (see next section “Units”).

If the insurance company is asking for “total charges,” then you may find the appropriate value listed under the “Total ($)” section of the receipt.

Your insurance provider may ask you to specify the number of “Units” for each CPT code.

For each CPT Code, you will find the number of units listed under the “Units” section of the receipt.

Your insurance company may ask you to provide “Modifiers” along with procedure/services (CPT) codes.

For each CPT Code, you will find 2-digit Modifier codes listed under the “Modifier” section of receipt.

NOTE: You may have “none” written under the “Modifier” section of the receipt. In this case, you do not have to enter anything for Modifiers.

Your insurance company may ask you to provide a “National Provider Identifier” number, also known as an “NPI” number. This number helps to identify the healthcare provider and/or healthcare practice that is providing services.

If your insurance company is asking for this information, and they DO NOT specify whether to include the Provider NPI or the Practice NPI, then we ask that you please:

If however the form specifically requests the Provider NPI, then you may include this information.

You may find the appropriate NPI # towards the bottom of the receipt under the “Provider NPI” or the “Practice NPI” sections of the receipt.

Your insurance company may ask you to record Convergent Movement and Performance’s Tax ID or EIN number.

You may find this information towards the bottom of the receipt under the “Tax ID/EIN” section of the receipt.

After you independently file your claim, your insurance company will either reimburse you directly or put the costs towards a deductible (depending on your specific plan).

Special Assistance with Filing Your Claims and Receiving Reimbursement

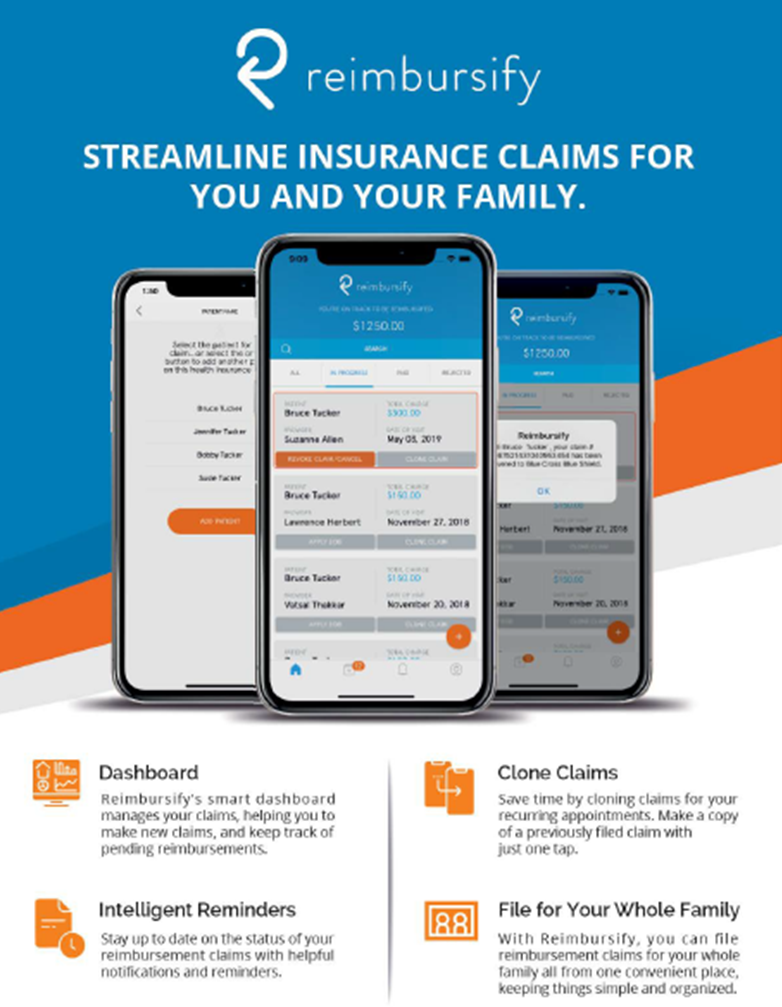

We are excited to provide you information on an incredible app that allows you to file your out-of-network insurance claim/s with your smart-phone in just a few short minutes.

This application is called “Reimbursify,” and it is available on Apple and Android smart-phones.

Reimbursify makes it quick and easy to file reimbursement claims with your insurance company, and even helps you keep track of your past and pending claims. You may find additional information on their website here: https://reimbursify.com/

Upon signing up with Reimbursify, the first claim you file is completely free. Each additional claim after that costs less than $2.

Please note: It is absolutely NOT required for you to use Reimbursify, and you may instead file your claims directly through your insurance company at no additional cost. We are just sharing this information simply because it is an incredible service that this company is offering for those that do not wish to independently file their claim.

The following includes the step-by-step process to using Reimbursify. If interested, please click on each step for additional details.

You may locate and download the application (“Reimbursify”) in your phone’s app store.

Signing up is fast and your first claim is always free. Onboarding will only take a few minutes. For a timely sign-up, please be prepared with the following items and information on hand:

During the process they will ask you to select your healthcare provider (i.e. Eugene Ketselman). Please reference the next step for details on finding and selecting the appropriate healthcare provider option.

Reimbursify allows you to quickly find your practitioner.

You will be asked to enter your provider’s information. The following includes the information they may ask:

Upon entering the name, it will provide you with a list of matching providers or practices.

Please be sure to select the correct option. Ensure that it lists:

Upon completing registration, it is suggested to enter the special promo-code prior to filing your first claim.

In this step they will ask you to enter information that can be found on the receipt we provide you after your session. The following includes details on where you can find key information on your receipt:

Lastly, please be prepared that the app may also ask you to take a photo of your receipt with your phone camera to attach to the claim.

Reimbursify will automatically submit the claim for you, and keep you updated on the outcome.

If your claim is rejected by your insurance company, Reimbursify’s expert system comes to the rescue. Their team of industry savvy professionals have identified the most common reasons that claims get rejected and they’ve embedded the pathway to resolution right into the app!

And there is never any additional charge if you need to resubmit an updated claim for the visit.

Please note: At this stage, the overall time it takes to hear back from your insurance company and receive reimbursement depends purely on the speed at which your insurance company processes claims.

Please click below

If my practice and approach sound like a good fit for you and your goals, I’d love to find a convenient time for us to meet. We can do an initial assessment, determine what’s going on, and discuss what the best next steps would be moving forward. Please click below to schedule a convenient time for your initial assessment session, and get ready to conquer your pain and become healthy, active, and fit!

If you still have questions, or would like to meet before getting started, I completely understand! Please don’t hesitate to click below and schedule a free consultation session where we can get to know one another and discuss what’s been going on. I will be happy to honestly explain whether and how I can help. Together, we will determine whether we’re a good fit.

If you have any other questions, or would like to discuss something prior to scheduling an initial assessment or free consult, please click below to send me a direct message. If you prefer to speak by phone, please click below to send me a direct message providing your name, phone number, and best time/s for me to return your call.

Contact

Convergent Movement and Performance serves out of Northern – Central New Jersey, conveniently located to those that live, work, and travel in the nearby towns of Bridgewater, Raritan, Branchburg, Somerville, Hillsborough, Warren, Martinsville, Watchung Hills, Bedminster, Basking Ridge, Bernardsville, Chatham, Westfield, and Piscataway within Somerset, Morris, Union, and Middlesex counties, NJ.

Mailing Address (for postage/packages only)

726 Route 202 South, Suite 320, Unit 200, Bridgewater, NJ 08807

Medical Disclaimer: The content and information within convergentmp.com are strictly based on opinions and thoughts, and therefore all content is educational only. Convergentmp.com and all related content should not be relied upon for the purpose of replacing formal medical care including but not limited to screening for pathology, movement evaluation, diagnostics, and treatment. It is also the sole responsibility of each and every individual reader, content consumer, and website visitor to consult with a licensed healthcare provider prior to carrying out any provided information. Dr. Ketselman and Convergent Movement and Performance LLC are in no way, shape, or form responsible or liable for any kind of adverse event, loss, risk, or other problem, which is sustained as a result of consulting convergentmp.com or information obtained in any other forms of communication.